เอสซีจี (SCG) ผู้นำอุตสาหกรรมปูนซีเมนต์ในอาเซียน แสดงความพร้อมร่วมเป็นเจ้าภาพจัดงาน INTERCEM Asia 2025 งานประชุมผู้ผลิตและผู้เกี่ยวข้องในเชนอุตสาหกรรมปูนซีเมนต์ระดับโลก แสดงถึงศักยภาพและความพร้อมการเป็นผู้นำขับเคลื่อนนวัตกรรมปูนซีเมนต์คาร์บอนต่ำและแสดงวิสัยทัศน์การเป็นผู้นำระดับภูมิภาคด้านนวัตกรรมวัสดุก่อสร้าง โซลูชันที่ยั่งยืน จุดพลังอุตสาหกรรมปูนซีเมนต์ด้วยปูนคาร์บอนต่ำ ยกระดับมาตรฐาน ด้านความยั่งยืนในเวทีสากล พร้อมชูศักยภาพความพร้อมของประเทศไทยในฐานะตลาดสำคัญของอุตสาหกรรมปูนซีเมนต์ในภูมิภาคเอเชีย ตั้งแต่วันที่ 6-8 พฤษภาคม 2568 ที่กรุงเทพมหานคร

INTERCEM Asia หนึ่งในเวทีการประชุมระดับโลกที่สำคัญของอุตสาหกรรมปูนซีเมนต์ ซึ่งรวบรวมผู้นำและผู้เชี่ยวชาญจากธุรกิจซีเมนต์และธุรกิจที่เกี่ยวข้องทั้ง Supply Chain ในอุตสาหกรรมปูนซีเมนต์โลก ผู้เข้าร่วม จะได้รับฟังวิสัยทัศน์เชิงลึกเกี่ยวกับทิศทางและแนวโน้มอุตสาหกรรมปูนซีเมนต์ในระดับโลก รวมถึงการนำเสนอนวัตกรรมและเทคโนโลยี เพื่อเสนอแนวทางการปรับตัวของอุตสาหกรรมปูนซีเมนต์ การที่ประเทศไทยได้รับเลือกเป็นเจ้าภาพในปีนี้ สะท้อนถึงศักยภาพของประเทศไทย และเอสซีจี เพื่อตอกย้ำพันธกิจขององค์กรในการขับเคลื่อน “Inclusive Green Growth” และนำเสนอมุมมองเชิงกลยุทธ์เกี่ยวกับการเปลี่ยนผ่านของอุตสาหกรรมสู่โมเดลธุรกิจที่เน้นความยั่งยืนและนวัตกรรมปูนซีเมนต์คาร์บอนต่ำ เพื่อตอบสนองต่อข้อกำหนด ด้านสิ่งแวดล้อมระดับโลกที่เข้มงวดมากขึ้น

ในยุคที่ “นวัตกรรมกรีน” ไม่ใช่เพียงทางเลือก

แต่เป็น “ทางรอด” ของธุรกิจ

แต่เป็น “ทางรอด” ของธุรกิจ

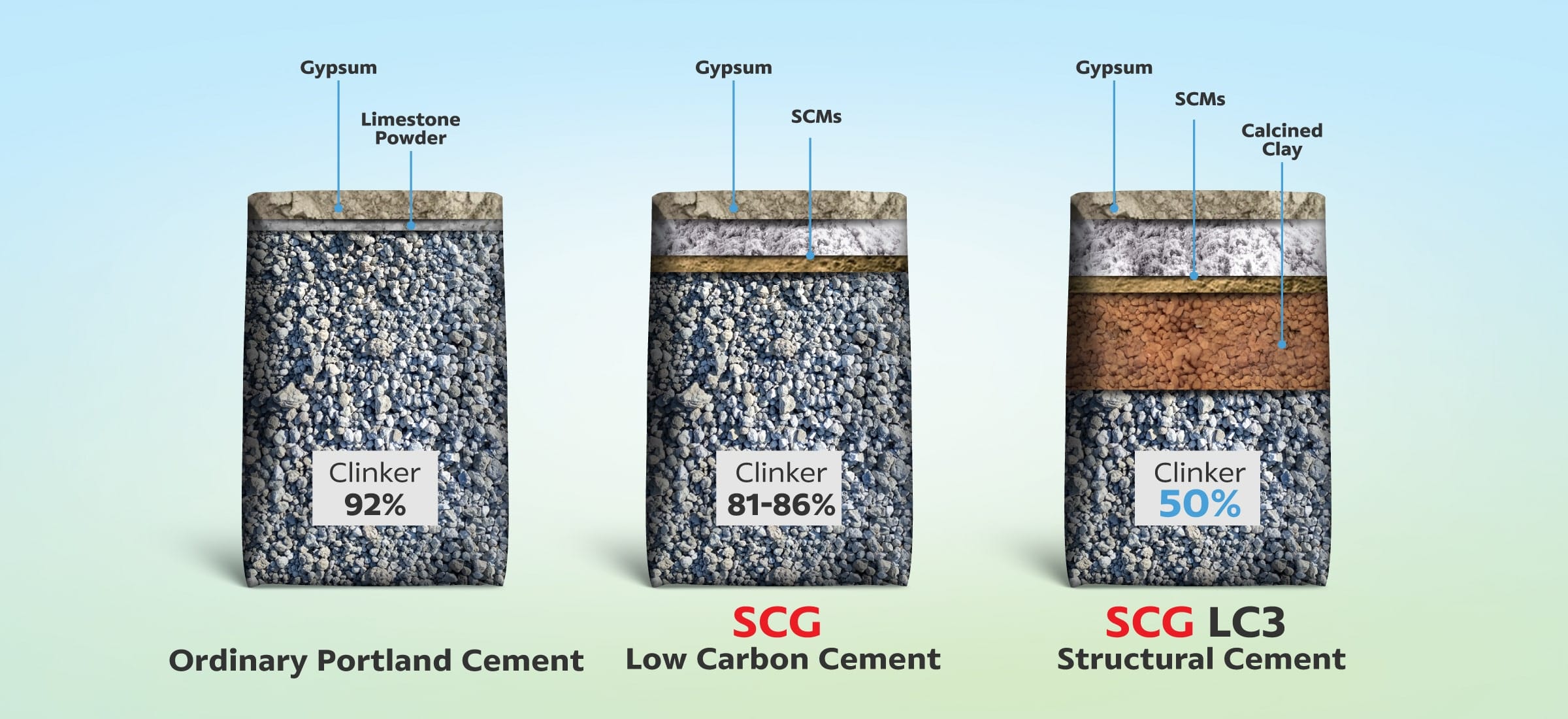

งาน INTERCEM Asia 2025 จะเป็นเวทีสำคัญในการหารือประเด็นเร่งด่วนที่ผู้ผลิตปูนซีเมนต์ทั่วโลกต้องปรับตัว โดยเฉพาะในด้านการลดการปล่อยก๊าซคาร์บอนไดออกไซด์ ซึ่งอุตสาหกรรมปูนซีเมนต์เป็นหนึ่งในสาเหตุในการสร้างภาวะโลกร้อน คิดเป็นสัดส่วน 7-8% ของการปล่อยก๊าซคาร์บอนไดออกไซด์ทั่วโลก ผู้ประกอบการในอุตสาหกรรมปูนซีเมนต์ยังต้องเตรียมพร้อมรับมือกับมาตรการใหม่ๆ โดยเฉพาะ Carbon Border Adjustment Mechanism (CBAM) ของสหภาพยุโรป ซึ่งเป็นกลไกปรับราคาคาร์บอนก่อนข้ามพรมแดนที่เรียกเก็บค่าธรรมเนียมคาร์บอนจากผู้นำเข้าสินค้าที่มีการปล่อยคาร์บอนสูง และ Carbon Tax หรือภาษีคาร์บอน ซึ่งเป็นการเก็บภาษีจากปริมาณการปล่อยก๊าซคาร์บอนไดออกไซด์ของผู้ผลิต มาตรการเหล่านี้จะส่งผลกระทบโดยตรงต่อขีดความสามารถในการแข่งขันและต้นทุนการผลิตของผู้ผลิตปูนซีเมนต์ทั้งในไทยและอาเซียน รวมถึงโอกาส ในการส่งออกสู่ตลาดโลก ท่ามกลางความท้าทายเหล่านี้ เอสซีจีได้วางรากฐานและลงทุนในนวัตกรรมปูนซีเมนต์คาร์บอนต่ำมาอย่างต่อเนื่อง จนก้าวขึ้นเป็นผู้นำและยกระดับอุตสาหกรรมปูนซีเมนต์ที่เป็นมิตรกับสิ่งแวดล้อม ของภูมิภาคอาเซียน ด้วยการเตรียมความพร้อมด้านกลยุทธ์ ด้านวิจัยและพัฒนา ด้านเทคโนโลยีการผลิต และการมองการณ์ไกลถึงแนวโน้มของอุตสาหกรรมปูนซีเมนต์โลกและอนาคตแห่งการอยู่อาศัยที่ยั่งยืน ภายในงานเอสซีจีจะนำเสนอนวัตกรรมระดับ First-to-Market ประกอบด้วย

SCG LC3 Structural Cement

ปูนซีเมนต์งานโครงสร้างคาร์บอนต่ำสูตรต้นแบบของไทย ที่พัฒนา จากองค์ความรู้เฉพาะของเอสซีจี สามารถลดการปล่อยก๊าซคาร์บอนไดออกไซด์ (CO₂) ได้มากถึง 38% เมื่อเทียบกับปูนงานโครงสร้างทั่วไป ขณะที่ยังคงคุณสมบัติด้านความแข็งแรงทนทานและสามารถประยุกต์ใช้งานตกแต่งได้อย่างลงตัว โดยมีเป้าหมายในการลดคาร์บอนให้ได้ถึง 50% ในอนาคตอันใกล้ สร้างมาตรฐานใหม่ให้กับอุตสาหกรรมปูนซีเมนนต์ในระดับภูมิภาคอาเซียน

SCG 3D Printing

เทคโนโลยีการพิมพ์ขึ้นรูปสามมิติด้วยปูนคาร์บอนต่ำ ที่ปฏิวัติวงการก่อสร้าง ด้วยความสามารถในการสร้างโครงสร้างที่มีความซับซ้อนสูง ตั้งแต่การออกแบบเส้นสาย ความโค้ง ไปจนถึงงานก่อสร้างหลายชั้น ตอบโจทย์งานสถาปัตยกรรมล้ำสมัย อีกทั้งยังสามารถใช้ในงานอนุรักษ์ ที่ช่วยฟื้นฟูระบบนิเวศทางทะเล เสริมศักยภาพการแข่งขันให้กับภาคอุตสาหกรรมก่อสร้างของไทย ในเวทีโลก

TORA S-ONE

นวัตกรรมเครื่องพ่นฉาบปูนระบบดีเซลที่เพิ่มประสิทธิภาพการทำงานได้อย่าง ก้าวกระโดด โดยเพิ่มความเร็วในการฉาบผนังปูนซีเมนต์ได้ถึง 40% และเพิ่มประสิทธิภาพในการใช้วัสดุ ให้คุ้มค่าสูงสุด ช่วยยกระดับมาตรฐานงานก่อสร้างไทยสู่ความเป็นเลิศ แก้ปัญหาขาดแคลนทักษะฝีมือแรงงาน

SCG International

ผู้นำด้านโซลูชัน Supply Chain แบบครบวงจร เพื่อช่วยพันธมิตรลดคาร์บอน และยกระดับศักยภาพการแข่งขัน ด้วยบริการครบวงจร (End-to-End Solutions) ที่ครอบคลุมตั้งแต่ การจัดหาวัตถุดิบ การขนส่ง ไปจนถึงการส่งมอบสินค้าถึงมือลูกค้า โดยคำนึงถึงการลดผลกระทบต่อสิ่งแวดล้อมตลอดห่วงโซ่อุปทาน

พัฒนานวัตกรรมสินค้าคู่ขนานกับกระบวนการผลิตที่เป็นมิตรต่อสิ่งแวดล้อม

เอสซีจี ไม่ได้มุ่งแค่พัฒนาสินค้าที่เป็นมิตรต่อสิ่งแวดล้อมเท่านั้น แต่ยังลงทุนต่อเนื่องใน กระบวนการผลิต ที่เป็นมิตรต่อสิ่งแวดล้อม อาทิ

การเปลี่ยนผ่านสู่อุตสาหกรรมปูนซีเมนต์คาร์บอนต่ำ ไม่ใช่แค่การปรับตัว

แต่ต้องการสร้างการยอมรับ การกำหนดมาตรฐาน

เพื่อสร้างความสามารถทางการแข่งขัน

แต่ต้องการสร้างการยอมรับ การกำหนดมาตรฐาน

เพื่อสร้างความสามารถทางการแข่งขัน

เอสซีจี มองว่าการเปลี่ยนผ่านสู่อุตสาหกรรมปูนซีเมนต์คาร์บอนต่ำ ไม่ใช่เพียงทางรอด แต่คือโอกาสเชิงกลยุทธ์ ที่จะยกระดับขีดความสามารถการแข่งขันของอุตสาหกรรมทั้งในไทย อาเซียน และระดับโลก และพาประเทศไทยก้าวขึ้นเป็น ผู้นำในอุตสาหกรรมปูนซีเมนต์และการก่อสร้างอย่างยั่งยืนในเวทีโลก

SCG International Corporation

ด้วยประสบการณ์ด้านการซื้อขายวัตถุดิบระหว่างประเทศ กว่า 45 ปี เราได้พัฒนาความเชี่ยวชาญอย่างลึกซึ้งในหลากหลายอุตสาหกรรม ตั้งแต่วัตถุดิบอุตสาหกรรม วัสดุก่อสร้าง สินค้าบ้านและที่อยู่อาศัย กระดาษและบรรจุภัณฑ์ อาหารและเครื่องดื่ม วัสดุรีไซเคิล ไปจนถึงพลังงาน ความรู้ที่กว้างขวางนี้ทำให้เราเป็นพันธมิตรที่น่าเชื่อถือด้านซัพพลายเชนระดับโลก ทำให้สามารถให้ข้อมูลตลาดเชิงลึกที่มีประโยชน์และเชื่อถือได้ ผ่านการนำเสนอบทความที่รวบรวมมาจากประสบการณ์อันยาวนาน ช่วยให้คุณมั่นใจได้ว่าจะสามารถจัดการกับความซับซ้อนของซัพพลายเชนได้อย่างมั่นคง